UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Under § 240.14a-12

CBL & ASSOCIATES PROPERTIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

[X] No fee required

[ ] Fee paid previously with preliminary materials.

[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14(a)-6(i)(1) and 0-11

April 24, 202322, 2024

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders which will be held on Wednesday, May 24, 202322, 2024 at 3:2:00 p.m. (EDT). In order to provide an opportunity for greater stockholder participation and reduce the environmental impact of our Annual Meeting, we have decided that our 20232024 Annual Meeting will be virtual again this year. You will be able to attend the meeting, vote and submit your questions live via webcast by visiting www.virtualshareholdermeeting.com/CBL2023.CBL2024.

The Notice and Proxy Statement on the following pages contain details concerning the business to come before the meeting. Please sign and return your proxy card in the enclosed envelope, or vote your shares by telephone or via the Internet, to ensure that your shares will be represented and voted at the meeting even if you cannot attend via the live webcast. Even if you plan to attend the meeting via the live webcast, you are urged to sign and return the enclosed proxy card (or voting instruction form, as applicable), or to vote your shares by telephone or via the Internet in accordance with the instructions on the enclosed proxy card or voting instruction form.

Thank you for your support.

Sincerely, |

|

|

Chief Executive Officer |

CBL & ASSOCIATES PROPERTIES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 24, 202322, 2024

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of CBL & Associates Properties, Inc., a Delaware corporation (the “Company”), will be held on Wednesday, May 24, 202322, 2024 at 3:2:00 p.m. (EDT) via live webcast by visiting www.virtualshareholdermeeting.com/CBL2023.CBL2024. You will need the 16-digit control number included on your proxy card or voting instruction form. The meeting will be held for the following purposes:

1. To act on the re-election of the Board of Directors’ sixseven director nominees to serve for a term of one year and until their respective successors are elected and qualified (“Proposal 1”);

2. To act upon a proposal to ratify the selection of Deloitte & Touche LLP (“Deloitte”) as the independent registered public accountants for the Company’s fiscal year ending December 31, 20232024 (“Proposal 2”);

3. To act upon a proposal for the advisory approval of the compensation of our Named Executive Officers as set forth herein (“Proposal 3”); and

4. To act upon an advisory vote on the frequency of future shareholder advisory votes relating to the compensation of our Named Executive Officers (“Proposal 4”); and

5. To consider and act upon any other matters which may properly come before the meeting or any adjournment thereof.

In order to provide an opportunity for greater stockholder participation and reduce the environmental impact of our Annual Meeting, we have decided that our 20232024 Annual Meeting will be virtual again this year. You are entitled to attend and participate in the Annual Meeting only if you were a shareholder of record as of the record date or hold a valid proxy for the meeting. Those shareholders will be able to attend the virtual Annual Meeting, vote their shares and submit questions during the meeting via live audio webcast by visiting: www.virtualshareholdermeeting.com/CBL2023.CBL2024. To participate, you will need the 16-digit control number included in your proxy materials or on your proxy card. Please note that there will be no in-person meeting for you to attend.

In accordance with the provisions of the Company’s Bylaws, the Board of Directors has fixed the close of business on Thursday,Monday, April 6, 2023,8, 2024, as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Annual Meeting.

Your attention is directed to the accompanying Proxy Statement.

Your vote is very important. Whether or not you plan to attend the meeting via live webcast, we urge you to submit your Proxy. To submit your Proxy by mail, please sign, date and promptly return the enclosed Proxy (or voting instruction form) in order to ensure representation of your shares. An addressed envelope for which no postage is required if mailed in the United States is enclosed for that purpose. Alternatively, you may use the toll-free telephone number indicated on the enclosed Proxy (or voting instruction form) to vote by telephone or visit the website indicated thereon to vote via the Internet. This will not prevent you from voting your shares during the meeting if you desire to do so.

By Order of the Board of Directors |

|

|

Chief Executive Officer |

Chattanooga, Tennessee

April 24, 202322, 2024

TABLE OF CONTENTS

1 | |

4 | |

4 | |

4 | |

5 | |

5 | |

5 | |

6 | |

7 | |

| |

| |

| |

| |

Operation of the Company’s Business; Certain Aspects of the Company’s Capital Structure |

|

| |

| |

| |

| |

| |

19 | |

| |

| |

| |

| |

| |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Equity Compensation Plan Information as of December 31, |

|

| |

| |

| |

| |

PROPOSAL 2 – RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS |

|

Independent Registered Public Accountants’ Fees and Services | 82 |

PROPOSAL 3 – ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

|

|

|

DATE FOR SUBMISSION OF SHAREHOLDER PROPOSALS AND RELATED MATTERS |

|

| |

|

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied in this summary to help you find further information in this Proxy Statement.

Our 20232024 Annual Meeting

Time and Date |

|

|

|

|

|

Location |

| The Annual Meeting will be held virtually via live webcast. You can join the meeting by visiting www.virtualshareholdermeeting.com/ and entering the 16-digit control number listed on your proxy card. |

|

|

|

Record Date |

| April |

|

|

|

Voting |

| Each share is entitled to one vote on each matter to be voted upon at our Annual Meeting. You can vote by proxy utilizing any of the following methods: |

|

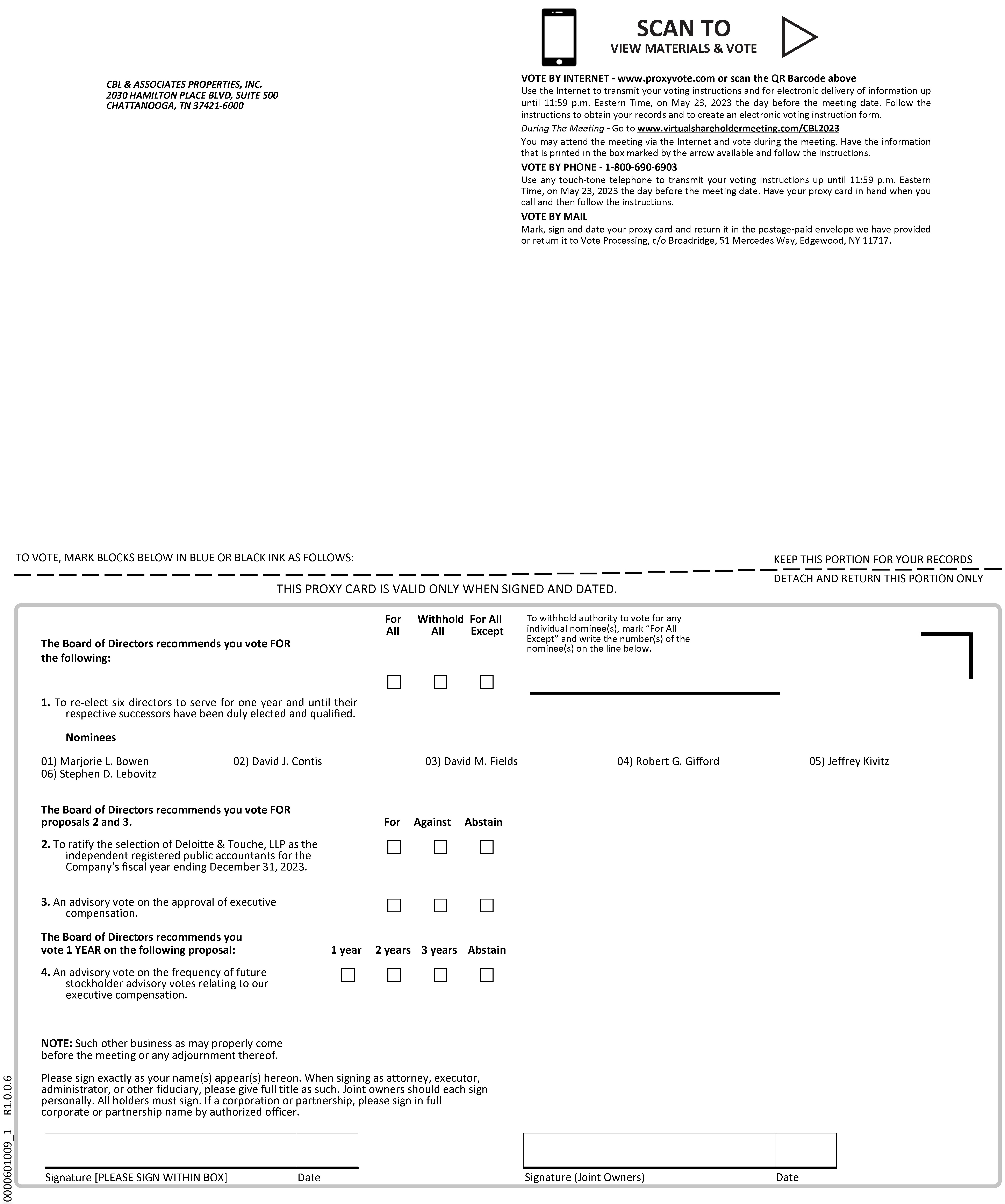

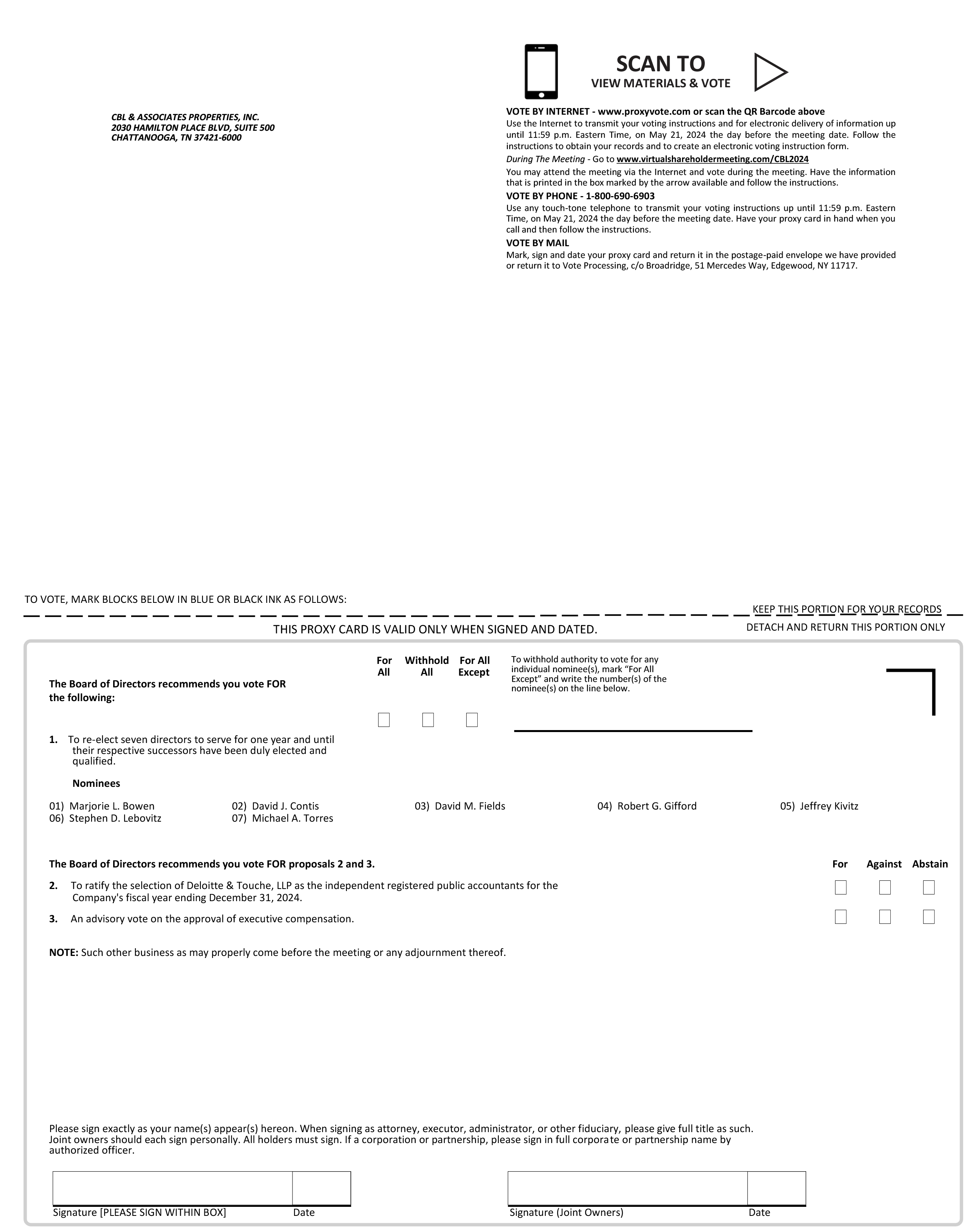

| • Internet: Go to the website shown on your Proxy or voting instruction form until 11:59 p.m. Eastern Time, the day before our Annual Meeting. • Telephone: As shown on the Proxy or voting instruction form you received until 11:59 p.m. Eastern Time, the day before our Annual Meeting. • Mail: Mark, sign, date and promptly return your Proxy or voting instruction form. • In Person at the Virtual Annual Meeting: You may vote in person during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/ |

Internet Availability |

| This Notice of Annual Meeting and Proxy Statement, as well as our Annual Report for the Company’s fiscal year ended December 31, |

This Proxy Statement was first provided to shareholders on or about April 24, 2023.22, 2024.

Annual Meeting Proposals and Board Recommendations

| Board | Page |

Proposal 1 – Election of Directors | For all nominees | 7 |

Proposal 2 – Ratification of the selection of Deloitte as our independent registered public accounting firm for | For |

|

Proposal 3 – Advisory Vote to Approve the Compensation of Our Named Executive Officers | For |

|

|

|

|

Transaction of any other business that properly comes before our Annual Meeting |

|

|

1

Director Nominees (Page 8)7)

|

|

|

|

| Board | Other Public |

|

|

|

| Board | Other Public |

Stephen D. Lebovitz | 62 | 1993 | Chief Executive Officer | No | None | 63 | 1993 | Chief Executive Officer | No | None | ||

David J. | 64 | 2021 | Non-Executive Chairman of the Board of the Company | Yes | Audit ($), Compensation | Equity Lifestyle Properties, Inc.; | 65 | 2021 | Non-Executive Chairman of the Board of the Company | Yes | Audit ($) | Equity Lifestyle Properties, Inc.; |

Marjorie L. Bowen | 57 | 2021 | Former Managing Director of the Fairness Opinion Practice at Houlihan Lokey, Inc. | Yes | Audit* ($), Nominating/ | Diebold Nixdorf, Incorporated; | 58 | 2021 | Former Managing Director of the Fairness Opinion Practice at Houlihan Lokey, Inc. | Yes | Audit* ($), Nominating/ | Diebold Nixdorf, Incorporated; |

David M. | 65 | 2021 | Executive Vice President, | Yes | Compensation, Nominating/ Corporate Governance* | EastGroup Properties, Inc. | 66 | 2021 | Executive Vice President, | Yes | Compensation, Nominating/ Corporate Governance* | EastGroup Properties, Inc. |

Robert G. Gifford | 66 | 2021 | Former Chief Executive Officer, | Yes | Audit ($), Compensation*, Nominating/ | Lehman Brothers Holding, Inc. | 67 | 2021 | Former Chief Executive Officer, | Yes | Audit ($), Compensation* | Lehman Brothers Holding, Inc. |

Jeffrey Kivitz | 39 | 2022 | Partner, | Yes | Compensation, Nominating/ Corporate Governance | None | ||||||

Jeffrey A. | 40 | 2022 | Partner, | Yes | Compensation, Nominating/ Corporate Governance | None | ||||||

Michael A. Torres | 63 | 2023 | Chief Executive Officer and portfolio manager of Adelante Capital Management | Yes | Audit ($), Compensation | None | ||||||

* Denotes Committee Chairman ($) Audit Committee Financial Expert | * Denotes Committee Chairman ($) Audit Committee Financial Expert | * Denotes Committee Chairman ($) Audit Committee Financial Expert | ||||||||||

2

2

Ratification of Auditors (Page 87)82)

We are asking our shareholders to ratify the appointment of Deloitte as the independent registered public accounting firm to serve as our auditors for the year ending December 31, |

Say-on-Pay (Page 89)84)

Consistent with our shareholders’ preference, our Board of Directors is providing shareholders with an annual vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in our Proxy Statement. Please review our Compensation Discussion and Analysis (beginning on page |

Advisory Vote on the Frequency of Future Say-on-Pay Votes Relating to Our Executive Compensation (Page 90)

|

3

3

PROXY STATEMENT

CBL & ASSOCIATES PROPERTIES, INC.

2030 Hamilton Place Blvd.

Suite 500

CBL Center

Chattanooga, Tennessee 37421

(423) 855-0001

ANNUAL MEETING OF SHAREHOLDERS

May 24, 202322, 2024

ANNUAL MEETING AND PROXIES

The enclosed proxy is solicited by and on behalf of the Board of Directors of CBL & Associates Properties, Inc., a Delaware corporation (the “Company” or “CBL”), for use at the annual meeting of shareholders of the Company (the “Annual Meeting”) to be held on Wednesday, May 24, 2023,22, 2024, at 3:2:00 p.m. (EDT) and at any and all postponements or adjournments thereof. This year’s annual meeting will be an entirely “virtual meeting” of shareholders. You will be able to attend the meeting as well as vote and submit your questions via live webcast by visiting www.virtualshareholdermeeting.com/CBL2023CBL2024 and entering the 16-digit control number included on your proxy card or on the voting instruction form you received from your broker. Any proxy given may be revoked at any time before it is voted by filing with the Secretary of the Company either an instrument revoking it or a duly executed proxy bearing a later date. All expenses of the solicitation of proxies for the Annual Meeting, including the cost of mailing, will be borne by the Company. In addition to solicitation by mail, Company officers and regular employees may solicit proxies from shareholders by telephone, telegram or personal interview but will not receive additional compensation for such services. The Company also intends to request persons holding stock in their name or custody, or in the name of nominees, to send proxy materials to their principals and request authority for the execution of the proxies. The Company will reimburse such persons for the associated expense.

In order to provide an opportunity for greater stockholder participation and reduce the environmental impact of our Annual Meeting, we have decided that our 20232024 Annual Meeting will be virtual again this year. You are entitled to attend and participate in the Annual Meeting only if you were a shareholder of record as of the record date or hold a valid proxy for the meeting. Those shareholders will be able to attend the virtual Annual Meeting, vote their shares and submit questions during the meeting via live audio webcast by visiting: www.virtualshareholdermeeting.com/CBL2023.CBL2024. Please note that there will be no in-person meeting for you to attend.

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 24, 2023:22, 2024:

The Company’s Notice of Annual Meeting and Proxy Statement for the Annual Meeting, as well as our Annual Report for the Company’s fiscal year ended December 31, 2022,2023, are also available at www.proxyvote.com.

VOTING AT THE ANNUAL MEETING

Only shareholders of record at the close of business on April 6, 20238, 2024 are entitled to vote on the matters to be presented at the Annual Meeting. The number of shares of the Company’s common stock, par value $.001 per share (“Common Stock”), outstanding on such date and entitled to vote was 32,060,922 shares.31,960,508 shares (excluding treasury shares).

4

Quorum Requirements

The presence in person or by proxy of holders of record of a majority of the outstanding shares of Common Stock is required for a quorum to transact business at the Annual Meeting with respect to those matters requiring approval by the holders of Common Stock (our only outstanding class of capital stock), but if a quorum should not be present, the Annual Meeting may be adjourned from time to time until a quorum is obtained.

Votes Necessary to Approve the Proposals

The vote required to approve each of the proposals at the Annual Meeting is as follows:

Each share of Common Stock is entitled to one vote with respect to those matters upon which such share is to be voted. No cumulative voting rights are authorized and dissenters’ rights are not applicable to these matters.

While the Company’s directors will be elected by plurality vote at the Annual Meeting, as further described below under “Corporate Governance Matters – Additional Policy Statements,” the Board of Directors has implemented a majority voting policy under our Corporate Governance Guidelines, which provides that a director who is nominated in an uncontested election, and who receives a greater number of votes “withheld” from his or her election than votes “for” such election, is required to immediately tender his or her resignation to the Board of Directors for consideration.

Under New York Stock Exchange (“NYSE”) Rule 452, NYSE member organizations are prohibited from giving a proxy to vote with respect to certain matters, including matters involving (i) an election of directors, (ii) any proposal related to executive compensation (including any shareholder advisory votes on the approval of executive compensation or on the frequency of such shareholder advisory votes) or (iii) an authorization to implement an equity compensation plan, or any material revision to the terms of any existing equity compensation plan, without receiving voting instructions from a beneficial owner. Therefore, brokers will not be entitled to vote shares at the Annual Meeting with respect to Proposal 1 Proposal 3 or Proposal 43 without instructions by the beneficial owner of the shares. Beneficial owners of shares held in broker accounts are advised that, if they do not timely provide instructions to their broker, their shares will not be voted in connection with the election of directors (Proposal 1), or with taking action on Proposal 3 or Proposal 4.the advisory resolution approving the compensation of our named executive officers (Proposal 3).

5

Voting Procedures

If your shares are registered directly in your name with our transfer agent, Computershare, you are considered the shareholder of record with respect to those shares and you are receiving a proxy card for the virtual Annual Meeting. If your shares are held in an account at a broker, bank or other similar organization, you are the beneficial owner of shares held in “street name” and you are receiving a voting instruction form. Holders of our Common Stock on the April 6, 20238, 2024 record date have three ways to vote: by mail, by phone and via the Internet using a computer:

By Mail: you may complete, sign and return your proxy card (or the voting instruction form received from your broker or bank, as applicable) by pre-paid mail.

By Telephone: you also may use the toll-free telephone number indicated on the proxy card or voting instruction form to vote by telephone until 11:59 p.m. Eastern Time the day before our Annual Meeting.

Via the Internet: you also may visit the website indicated on the proxy card or voting instruction form to vote via the Internet, until 11:59 p.m. Eastern Time the day before our Annual Meeting, or vote online during the virtual Annual Meeting, as describe below.

You must enter the 16-digit control number found on your proxy card (or voting instruction form) in order to vote in advance of the Annual Meeting as described above, and to vote and/or to participate during the Annual Meeting by visiting: www.virtualshareholdermeeting.com/CBL2023.CBL2024. (If you are a “street name” holder and previously requested a legal proxy from your broker, bank or other similar organization, you may also use such legal proxy to vote at and/or participate in the Annual Meeting.) Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote in advance of the Annual Meeting by one of the methods described above.

As noted above, under the rules of the NYSE, on certain routine matters brokers may, at their discretion, vote shares they hold in “street name” on behalf of beneficial owners who have not returned voting instructions to the brokers. Routine matters include the ratification of the selection of the independent registered public accountants (Proposal 2). In instances – such as voting on Proposals 1 3 and 43 at the Annual Meeting – where brokers are prohibited from exercising discretionary authority (so-called “broker non-votes”), the shares for which they have not received voting instructions are counted as present for the purpose of determining whether or not a quorum exists at the Annual Meeting, but are not included in the vote totals. Because broker non-votes are not included in the vote, they are not counted as votes cast “for” or “against” a proposal. Accordingly, assuming the presence of a quorum at the Annual Meeting, abstentions and broker non-votes will have no effect on the election of any nominee for director under Proposal 1, so long as such nominee receives any affirmative votes, and also will have no effect on the ratification of the selection of the independent registered public accountants under Proposal 2 or the advisory resolution approving compensation of our named executive officers under Proposal 3, or the approval, on an advisory basis, of the selection of every one, two or three years as the frequency with which the Company will hold advisory votes on executive compensation under Proposal 4.3.

Unless contrary instructions are indicated on the accompanying form of proxy, the shares represented thereby will be voted by the persons named as proxies on such form FOR the election of the Board of Directors’ nominees for re-election as directors of the Company as described in Proposal 1; FOR ratification of the selection of Deloitte as the independent registered public accountants for the Company’s fiscal year ending December 31, 20232024 as described in Proposal 2; and FOR the advisory resolution approving compensation of our Named Executive Officers as described in Proposal 3 and FOR the selection of “one year” as the frequency with which the Company will hold advisory votes on executive compensation as described in Proposal 4.3.

6

PROPOSAL 1

ELECTION OF DIRECTORS

General

Director Charles B. Lebovitz, Chairman Emeritus, will not stand for re-election this year. Our Board of Directors, upon the recommendation of our Nominating/Corporate Governance Committee, has nominated six of the Company’s seven current directors for re-election by shareholders at this year’s Annual Meeting. A majority of our directors are unaffiliated (“Independent Directors”) with the Company and its predecessor entity, CBL & Associates, Inc. and its affiliates (“CBL’s Predecessor”). Since the Company’s 2014 Annual Meeting, following the declassification of our Board of Directors as approved by our shareholders, all directors have been elected on an annual basis.

Our Board of Directors has delegated to the Nominating/Corporate Governance Committee, pursuant to the provisions of such Committee’s Charter and our Company’s Corporate Governance Guidelines, the responsibility for evaluating and recommending to the Board candidates to be considered as nominees for election as directors of our Company. In discharging these responsibilities, the Nominating/Corporate Governance Committee may solicit recommendations from any or all of the following sources: the Independent Directors, the Chairman of the Board, the Chief Executive Officer, other executive officers, third-party search firms or any other source it deems appropriate. The Nominating/Corporate Governance Committee’s criteria for the evaluation and selection of director candidates are described in more detail below under “Board of Directors’ Meetings and Committees – Nominating/Corporate Governance Committee.”

Impact of Our Voluntary Reorganization Under Chapter 11

Beginning on November 1, 2020, the Company and CBL & Associates Limited Partnership, a Delaware limited partnership (the Company’s “Operating Partnership”), together with certain of its direct and indirect subsidiaries (collectively, the “Debtors”) filed voluntary petitions (the “Chapter 11 Cases”) under chapter 11 of title 11 (“Chapter 11”) of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). On November 1, 2021 (the “Effective Date”), by operation of the Debtors’ Third Amended Joint Chapter 11 Plan of CBL & Associates Properties, Inc. and its Affiliated Debtors (With Technical Modifications) (the “Plan”), the conditions to effectiveness of the Plan were satisfied and the Debtors emerged from the Chapter 11 Cases. On the Effective Date, all outstanding shares of the Company’s previously outstanding common stock, par value $0.01 per share (the “Old Common Stock”), as well as all outstanding shares of the Company’s previously outstanding preferred stock and related depositary shares (the “Old Preferred Stock”) were cancelled. The Operating Partnership’s previously outstanding common and special common units of limited partnership (the “Old LP Common Interests”), as well as its previously outstanding preferred units of limited partnership related to our Old Preferred Stock (the “Old LP Preferred Interests”) also were cancelled, as were all three series of the Operating Partnership’s previously outstanding publicly traded senior notes (the “Old Senior Notes”). Pursuant to the Plan, on the Effective Date (A) the Company issued (i) 1,089,717 shares of its new Common Stock to (a) holders of its Old Common Stock and (b) certain holders of the Old LP Common Interests that elected to receive shares of its new Common Stock in exchange for Old LP Common Interests, (ii) 1,100,000 shares of its new Common Stock to holders of the Old Preferred Stock, (iii) 15,685,714 shares of its new Common Stock to holders of the Old Senior Notes and other general unsecured claims, and (iv) 2,114,286 shares of its new Common Stock to existing holders of Consenting Crossholder Claims (as defined in the Plan) and (B) the Operating Partnership issued 200,000 new common units of general partner interest and 19,789,717 new common units of limited partner interest (the “New LP Interests”) to subsidiaries of the Company and issued 10,283 New LP Interests to certain of the holders of Old LP Common Interests that elected to remain limited partners in the Operating Partnership under the Plan.

Immediately following these transactions on the Effective Date, the Company had an aggregate of 20,000,000 shares of its new Common Stock issued and outstanding (on a fully diluted basis after giving effect to any future election to exchange all New LP Interests for the new Common Stock). On the Effective

7

Date, the Company also reserved an additional (i) approximately 9,000,000 shares of the new Common Stock for issuance upon the potential exercise of exchange rights by the Company or the holders of $150,000,000 of new 7.0% exchangeable senior secured notes due 2028 issued pursuant to the Plan (the “Exchangeable Notes”) and (ii) 3,222,222 shares of New Common Stock for issuance under the new CBL & Associates Properties, Inc. 2021 Equity Incentive Plan that was subsequently adopted by the Company pursuant to the Plan. As a result, pursuant to the Plan: (i) holders of (a) Old Common Stock and (b) Old LP Common Interests received 5.50% of the outstanding shares of the new Common Stock (on a fully diluted basis after giving effect to any future election to exchange all New LP Interests for new Common Stock), (ii) holders of Old Preferred Stock received 5.50% of the outstanding shares of the new Common Stock, (iii) holders of Old Senior Notes and general unsecured claims received 78.43% of the outstanding shares of the new Common Stock and (iv) holders of Consenting Crossholder Claims received 10.57% of the outstanding shares of the new Common Stock (in each case subject to dilution by awards issued or issuable under the 2021 Equity Incentive Plan on or after the Effective Date and shares of New Common Stock issuable upon any exchange of Exchangeable Notes).

Additional information concerning the terms of the Plan and the Chapter 11 Cases, as well as the new securities issued pursuant to the Plan, is contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC, that accompanies this Proxy Statement.

Delaware Litigation

On January 12, 2023, a putative Company stockholder filed a proposed class action lawsuit in the Delaware Court of Chancery, styled Haynes v. Lebovitz, et al., 2023-0033-NAC (Del. Ch.) (the “Delaware Action”). The Delaware Action alleged, among other things, that the Company’s board of directors breached their fiduciary duties in setting March 25, 2022 as the record date for the May 26, 2022 annual meeting, contending that the record date was set for 62 days in advance of the annual meeting, and thus was in violation of Delaware law, which requires the record date for an annual meeting to be set for no more than 60 days in advance of the annual meeting. Through the Delaware Action, the plaintiff sought, among other relief, a judicial order declaring the 2022 annual meeting a nullity and the election of directors void. The Company and the board of directors denied and continue to deny any wrongdoing associated with the miscalculation of the record date. Further, the Company has determined that even though the record date had been set 62 days in advance of the 2022 annual meeting, and thus each director who stood for reelection at the 2022 annual meeting was not reelected, each of the Company’s directors nonetheless continued to validly hold office as holdover directors pursuant to Delaware law. The Company has further determined that given the directors’ status as holdover directors, any defect in the election of directors that occurred at the 2022 annual meeting would be cured through a valid reelection of any such director at the 2023 annual meeting. Company counsel conveyed this view to plaintiffs’ counsel in the Delaware Action. On February 15, 2023, the Delaware Action was voluntarily dismissed

Director Nominees

Upon the recommendation of the Nominating/Corporate Governance Committee, our Board intends to present for action at the Annual Meeting the re-election of Stephen D. Lebovitz, Marjorie L. Bowen, David J. Contis, David M. Fields, Robert G. Gifford, Jeffrey A. Kivitz and Jeffrey Kivitz,Michael A. Torres, each to serve for a term of one year and until their successors are duly elected and shall qualify. Stephen D. Lebovitz serves as Chief Executive Officer of the Company, and David J. Contis serves as Non-Executive Chairman of the Board. Messrs. Contis, Fields, Gifford, Kivitz and KivitzTorres and Ms. Bowen are the Company’s fivesix Independent Directors. Unless authority to vote for such nominees is withheld, the enclosed proxy will be voted for such nominees, except that the persons designated as proxies reserve discretion to cast their votes for other persons in the unanticipated event that any of such nominees is unable or declines to serve.

Mr. KivitzTorres was initially appointed to the Board effective August 10, 2022,June 15, 2023, and was recommended to the Nominating/Corporate Governance Committee and the Board for consideration by Canyon Partners LLC (together with its affiliates, “Canyon”) and by the Company’s Chief Executive Officer. Mr. Contis was appointed as the Non-Executive Chairman of the Company’s Board effective January 25, 2023,David Contis and by Chief Executive Officer Stephen Lebovitz, based on his expertise and experience in connection with the resignation fromcommercial real estate and securities industries as well as his prior experience serving as a director on the Boardboards of other companies similar to the then-current Non-Executive Chairman, Jonathan M. Heller, due to a change in his principal business association.Company.

8

Summary of Board Experience As a general matter, our Board believes that each of our directors has valuable individual qualifications, attributes and skills including significant leadership and strategic planning expertise gained through experience in one or more of the fields and capacities summarized below that, taken together, provide us with the variety and depth of knowledge, judgment and vision necessary to provide effective oversight of the management of a publicly traded real estate investment trust (“REIT”) in

7

the shopping center industry such as our Company. The following table highlights our directors’ experience, qualifications, attributes and skills:

| S. | M. | D. | D. | R. | J. | M. |

Chief Executive Officer/President/Founder | X |

| X |

| X |

| X |

Chief Operating Officer/Business Unit Chief Executive |

|

| X | X |

|

| |

Commercial Real Estate | X |

| X | X | X |

| X |

Financial Services / | X | X | X |

| X | X | X |

Investment Banking |

| X |

|

|

|

| |

Legal Services |

|

| X | X |

|

| |

Corporate Restructuring |

| X | X |

| X | X | |

Corporate Governance |

| X | X | X |

|

| X |

Retail Operations |

|

| X | X |

|

| |

International Business Experience |

|

| X |

|

|

| |

M&A Transactional Experience / | X | X | X |

| X | X | X |

Risk Oversight / Management | X | X | X | X | X | X | X |

Financial Literacy | X | X | X | X | X | X | X |

Accounting / Audit |

| X | X |

|

|

| X |

Human Capital Management / |

|

| X | X | X |

| X |

ESG Experience |

|

| X | X |

| X | |

Gender Diversity |

| X |

|

|

|

| |

Ethnic Diversity |

|

|

| X |

|

| X |

Additional details concerning the senior executive management, professional, public company and philanthropic leadership experiences that our Board, with the advice of the Nominating/Corporate Governance Committee, has determined qualify each director for service on our Company’s Board of Directors are set forth in each individual’s biography presented below. For each of these individuals, the position(s) shown in the left column represents the individual’s position(s) with the Company and with CBL & Associates Management, Inc., a Delaware corporation (the “Management Company”), through which the Company’s property management and development activities are conducted.

9

8

DIRECTOR NOMINEE |

| BIOGRAPHICAL INFORMATION |

|

|

|

|

|

|

Stephen D. Lebovitz Chief Executive Officer Director since 1993 Age – |

| Stephen D. Lebovitz serves as Chief Executive Officer of the Company, and also served as President of the Company prior to Michael I. Lebovitz being promoted to serve as President in June 2018. He previously served as President and Secretary of the Company from February 1999 to January 1, 2010, when he became President and Chief Executive Officer, and has served as a director of the Company since the completion of its initial public offering in November 1993. Since joining CBL’s Predecessor in 1988, Mr. Lebovitz has also served as Executive Vice President – Development/Acquisitions, Executive Vice President – Development, Senior Vice President – New England Office, and as Senior Vice President – Community Center Development and Treasurer of the Company. Before joining CBL’s Predecessor, Mr. Lebovitz was affiliated with Goldman, Sachs & Co. from 1984 to 1986.

Mr. Lebovitz is currently |

|

|

|

|

|

|

|

|

|

David J. Contis Chairman of the Board Director since 2021 Age – |

| David J. Contis joined the Board on November 1, 2021. Mr. Contis is the Non‑Executive Chairman of the Company’s Board of Directors and serves as a member of the Audit

Mr. Contis has served on the boards of various companies, including his current service on the board of Equity Lifestyle Properties, Inc. a NYSE-listed REIT, where he chairs the Compensation, Nominating and Corporate Governance Committee and serves as a member of the Audit Committee. Mr. Contis also is a director and serves on the Investment Committee of Acosta Verde, which owns and operates shopping centers in Mexico and is listed on the Mexican Stock Exchange. He also serves as Senior Managing Director of the private Chai Trust Company. Mr. Contis is a graduate of DePaul University and DePaul University College of Law. |

|

|

|

|

|

|

109

DIRECTOR NOMINEE |

| BIOGRAPHICAL INFORMATION |

|

|

|

|

|

|

Marjorie L. Bowen Director since 2021 Age – |

| Marjorie L. Bowen joined the Board as of November 1, 2021. Ms. Bowen serves as Chair of the Audit Committee and as a member of the Nominating/Corporate Governance Committee of the Company’s Board of Directors. Ms. Bowen is a former Managing Director of the fairness opinion practice at Houlihan Lokey, having served in that capacity from 2000 through 2007 after having originally joined Houlihan Lokey in 1989. She has significant experience in the public REIT sector and has served as a Board member of numerous public and private companies in a variety of industries and has extensive Board experience with companies undergoing restructuring.

A qualified NYSE and NASDAQ financial expert, Ms. Bowen has chaired Special Committees, Audit Committees and Restructuring/Strategic Committees. In 2023, Ms. Bowen was appointed to the Board of Directors of Diebold Nixdorf, Incorporated, where she currently serves on the Audit Committee and |

|

|

|

|

|

|

|

|

|

David M. Fields Director since 2021 Age – |

| David M. Fields joined the Board as of November 1, 2021. Mr. Fields serves as Chair of the Nominating/Corporate Governance Committee and as a member of the Compensation Committee of the Company’s Board of Directors. Mr. Fields has over 30 years of experience leading operations, administration and legal affairs for companies with large-scale branded real estate holdings. Since 2014, he has served as Executive Vice President, Chief Administrative Officer and General Counsel for Sunset Development Company, the developer of Northern California’s 585-acre Bishop Ranch. Prior to joining Sunset Development, Mr. Fields served as Executive Vice President, Chief Administrative Officer at Bayer Properties. Mr. Fields joined Bayer from the Irvine Company in Newport Beach, California, where he served as Vice President and General Counsel of Irvine’s retail properties division.

Mr. Fields also currently serves as a director and a member of the Board’s Compensation and Nominating and Corporate Governance Committees of EastGroup Properties, Inc., a NYSE-listed real estate investment trust focused on industrial properties. Mr. Fields is a graduate of Yale University and received his law degree from Harvard University. |

|

|

|

1110

DIRECTOR NOMINEE |

| BIOGRAPHICAL INFORMATION |

|

|

|

|

|

|

Robert G. Gifford Director since 2021 Age – |

| Robert G. Gifford joined the Board as of November 1, 2021. Mr. Gifford serves as Chair of the Compensation Committee and as a member of the Audit

Mr. Gifford currently serves as a Director of Lehman Brothers Holding Inc., and previously served on the Boards of NYSE-listed real estate investment trusts Retail Properties of America (2016-2021) and Liberty Property Trust (2018-2020). He is also a member of the Advisory Boards of The Davis Companies, a private real estate investor, developer and operator based in Boston, Massachusetts, and Milhaus, a private multi-family developer based in Indianapolis, Indiana. Mr. Gifford received a B.A. from Dartmouth College and a master’s degree in Public and Private Management from the Yale School of Management. |

|

|

|

|

|

|

|

|

|

Jeffrey A. Kivitz Director since 2022 Age – |

| Jeffrey A. Kivitz joined the Board on August 10, 2022. Mr. Kivitz serves as a member of the Compensation and Nominating/Corporate Governance Committees of the Company’s Board of Directors. Mr. Kivitz is a Partner in Canyon Partners LLC (together with its affiliates, “Canyon”), where he focuses on investments in the technology, software, building product, financial and retail sectors. Prior to joining Canyon in August of 2008, Mr. Kivitz worked as a consultant in both the private equity and general consulting practices at Bain & Company, where he acted as an advisor on buyout and corporate strategy. Mr. Kivitz received a B.A. in Economics, cum laude, from Williams College.

|

| ||

Michael A. Torres Director since 2023 Age – 63 | Michael A. Torres joined the Board as of June 15, 2023. Mr. Torres serves as a member of the Audit and Compensation Committees of the Company’s Board of Directors. Mr. Torres is Chief Executive Officer and portfolio manager of Adelante Capital Management, having joined Adelante in February 1995. He has over 37 years of real estate and securities research experience. Prior to joining Adelante, Mr. Torres was the Director of Real Estate Research and a portfolio manager for Wilshire Asset Management. At Wilshire, he created the Wilshire Real Estate Securities Index, widely recognized as the industry’s performance benchmark. Mr. Torres serves on the Board of Directors of Renova Therapeutics, and Colovore LLC. He is on the Cristo Rey De La Salle HS President’s Advisory Council, the BEE Partners LP Advisory Board, and Investment Committee for the Stern Grove Festival Foundation. He has also served as a UC Berkeley Foundation Trustee. Mr. Torres is currently an active member of the NorCal YPOG Chapter. Mr. Torres received a B.A. in Architecture and an M.B.A. from University of California, Berkeley. | |

|

|

|

| ||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RE-ELECTION OF THE DIRECTOR NOMINEES NAMED ABOVE | ||

11

12

Additional Executive Officers

Set forth below is information with respect to those individuals serving as executive officers of the Company as of April 6, 20238, 2024 (other than Stephen D. Lebovitz):

Name | Age | Current Position (1) |

|

|

|

Andrew F. Cobb |

| Executive Vice President – Accounting |

Jennifer H. Cope | 44 | Executive Vice President – Operations Services & Risk Management |

Jeffery V. Curry |

| Chief Legal Officer and Secretary |

Howard B. Grody |

| Executive Vice President – Leasing |

Benjamin W. Jaenicke |

| Executive Vice President – Chief Financial Officer and Treasurer |

Joseph H. Khalili | 44 | Executive Vice President – Financial Operations |

Alan L. Lebovitz |

| Executive Vice President – Management |

Michael I. Lebovitz |

| President |

Katie A. Reinsmidt |

| Executive Vice President – Chief |

(1) The position shown represents the individual’s position with the Company and with the Management Company.

Charles B. Lebovitz serves as Chairman Emeritus of the Company. Mr. Lebovitz served as Chairman of the Board of the Company from the completion of its initial public offering in November 1993 through November 1, 2021, at which time he became Chairman Emeritus. He previously served as Chief Executive Officer of the Company from the 1993 initial public offering until 2010, and also served as President of the Company until February 1999. Prior to the Company’s formation, he served in a similar capacity with CBL’s Predecessor. Mr. Lebovitz has been involved in shopping center development since 1961 when he joined his family’s development business. In 1970, he became affiliated with Arlen Realty & Development Corp. (“Arlen”) where he served as President of Arlen’s shopping center division, and, in 1978, he founded CBL’s Predecessor together with his associates.

Mr. Lebovitz is an Advisory Director of First Horizon Bank, N.A., Chattanooga, Tennessee and a member of the Urban Land Institute. He is a past president of the B’nai Zion Congregation in Chattanooga, a member of the National Board of Directors of Maccabiah USA/Sports for Israel (Maccabiah Games), and a National Vice Chairman of the United Jewish Appeal. He was the Campaign Chair for the Jewish Federation of Greater Chattanooga in 1989 and served as President in 1990-91. Mr. Lebovitz also has previously served as Chairman of the ICSC and as a Trustee and Vice President (Southern Division) of the ICSC and is a former member of the Board of Governors of NAREIT. He is a former member of the Chancellor’s Round Table for the University of Tennessee at Chattanooga, a Past President of the Alumni Council for The McCallie School, Chattanooga, and a past member of The McCallie School Board of Trustees, where he was named the recipient of the 1995 Distinguished Alumnus Award. He also is a past member of the Board of Trustees for Girls’ Preparatory School in Chattanooga. Mr. Lebovitz received the 2015 Leadership Fundraiser of the Year Award from the Association of Fundraising Professionals in conjunction with National Philanthropy Day. Mr. Lebovitz received his Bachelor of Arts degree in Business from Vanderbilt University. He is the father of Company executive officers Stephen D. Lebovitz, Michael I. Lebovitz and Alan L. Lebovitz.

Andrew F. Cobb serves as Executive Vice President – Accounting, a position to which he was promoted in September 2021. He also serves as a member of the Company’s Benefits Committee. Mr. Cobb joined CBL in June 2002 as Vice President – Accounting, and previously served as Senior Vice President – Director of Accounting from February 2015 through his promotion in September 2021 and as Vice President – Director of Accounting from February 2007 to February 2015. Prior to joining the Company, Mr. Cobb was with Arthur Andersen LLP from 1991 to 2002, serving as an audit manager from 1996 to 2002. Mr. Cobb is a certified public accountant, licensed in the

13

State of Tennessee and a member of the Tennessee Society of Certified Public Accountants. Mr. Cobb received a Bachelor of Science in Accounting from Tennessee Technological University.

Jennifer H. Cope serves as Executive Vice President – Operations Services & Risk Management, a position to which she was promoted in May 2023. Ms. Cope joined CBL in 2001 as a junior financial services analyst and held various roles supporting financial services. In 2015, she transitioned to CBL’s business transformation team and was promoted to Vice President – Shared Services. In that role, Ms. Cope led the Company’s Shared Services and Operations Services divisions and, in 2021, she was promoted to Senior Vice President – Operations Services. Throughout her tenure with CBL, Ms. Cope has served various roles including supporting and participating in the Company’s insurance programs, risk management programs, technology initiatives, joint venture relations, loan closings and operations services. Ms. Cope received a Bachelor of Science in Finance and a Master of Business Administration degree from the University of Tennessee at Chattanooga.

Jeffery V. Curry serves as Chief Legal Officer and Secretary of the Company. Mr. Curry initially was appointed to serve as Interim Chief Legal Officer of the Company simultaneously with the creation of the Chief Legal Officer position by the Board in February 2012, which appointment was made permanent effective April 3, 2012. He was appointed Secretary of the Company effective September 10, 2012. Mr. Curry also serves as the Company’s Compliance Officer. He previously had served since 1986 as a legal advisor to the Company. Prior to joining the Company, Mr. Curry was a partner in the national law firm of

12

Husch Blackwell LLP, counsel to the Company, a position he held since 2006 when he joined the local office of that firm along with a group of lawyers relocating from a firm that formerly provided legal services to the Company. Mr. Curry received his Doctor of Jurisprudence degree in 1985 from the University of Memphis Cecil C. Humphreys School of Law, where he was on the Editorial Board of the Law Review, and received a LL.M. in Taxation from New York University School of Law in 1986. Mr. Curry serves as a vice president and a member of the board of directors for Chattanooga Inner City Outreach, Inc., a local non-profit organization, and he is a member of the Chattanooga Bar Association and the Tennessee Bar Association.

Howard B. Grody serves as Executive Vice President – Leasing, a position to which he was promoted in September 2021. Mr. Grody previously served as Senior Vice President – Leasing of the Company from June 2008 through his promotion in September 2021 and as Vice President – Mall Leasing since 2000. Mr. Grody joined CBL in 1991 as a Leasing Manager for the Turtle Creek Mall development in Hattiesburg, Mississippi, and subsequently was promoted to the position of Senior Leasing Manager, where he had leasing responsibility for many of the Company’s properties throughout the country. Prior to joining CBL, Mr. Grody worked in the real estate industry with Sizeler Real Estate Properties. Mr. Grody was awarded the designation of Certified Leasing Specialist as recognized by ICSC in 1994, the program’s inaugural year, and was awarded the designation of Senior Certified Leasing Specialist in 2008. Mr. Grody has served two terms on the ICSC Certified Leasing Specialist Committee. Mr. Grody received his Bachelor of Science in Management degree from Tulane University.

Benjamin W. Jaenicke serves as Executive Vice President -– Chief Financial Officer and Treasurer, a position he has held since January 2023. Mr. Jaenicke joined CBL in September 2022 as Executive Vice President -– Finance. Prior to joining CBL, Mr. Jaenicke spent more than a decade with Wells Fargo (and predecessor firm Eastdil Secured) in real estate investment banking. In his role at Wells Fargo, he worked closely with executives across the real estate industry on strategic and capital planning including advising clients on M&A transactions, recapitalizations, and capital markets executions. Prior to joining Wells Fargo/Eastdil, he worked at PricewaterhouseCoopers where he performed audits and other accounting services for public REIT clients. Mr. Jaenicke holds a Bachelor of Science in Business and a Master of Accounting from Miami University and received his MBA from the University of Virginia Darden School of Business. He is a CFA charterholder and former Certified Public Accountant.

Joseph H. Khalili serves as Executive Vice President – Financial Operations, a position to which he was promoted in May 2023. Mr. Khalili joined CBL in 2012 as a portfolio accountant focused on third-party managed properties and was promoted to Acquisitions Analyst in 2014. In 2016, he assumed the role of Director – Financial Planning and Analysis and, in 2019, was promoted to Vice President – Financial Operations and Administration. As Mr. Khalili assumed and continued his leadership of the Company’s financial planning and budgeting teams, he was promoted to Senior Vice President – Financial Operations and then to his current position. Prior to joining CBL, Mr. Khalili spent seven years with General Growth Properties. Mr. Khalili received his Bachelor of Science in Finance from the University of Tennessee at Chattanooga.

Alan L. Lebovitz serves as Executive Vice President – Management of the Company. Mr. Lebovitz served as Senior Vice President - Asset Management of the Company from February 2009 to February 2018, when he was promoted to his current position. He previously served as Vice President - Asset Management having held that position from 2002 through February 2009, and had served in various positions in management, leasing and development since joining the Company in 1995. Prior to joining CBL in 1995, Mr. Lebovitz received his B.A. from Northwestern University in 1990, was affiliated with Goldman, Sachs & Co. from 1990 to 1992 and obtained an M.B.A. from Vanderbilt University. He has been an active community volunteer for organizations that include: Alzheimer Association’s Mid‑South Chapter, B’nai Zion Synagogue, Chattanooga Area Chamber of Commerce - Leadership Chattanooga and Workforce Development Task Force, Chattanooga Public Education Foundation, Jewish Federation of Greater Chattanooga, The McCallie School, Normal Park Museum Magnet School, and United Way of Greater Chattanooga. Alan L. Lebovitz is a son of Charles B. Lebovitz and a brother of Stephen D. Lebovitz and Michael I. Lebovitz.

1413

Michael I. Lebovitz serves as President of the Company. Mr. Lebovitz served as Executive Vice President – Development and Administration of the Company from January 2010 through June 2018, when he was promoted to his current position. Mr. Lebovitz also served as Senior Vice President – Chief Development Officer of the Company from June 2006 through January 1, 2010. Previously, he served the Company as Senior Vice President – Mall Projects, having held that position since January 1997. Prior to that time, Mr. Lebovitz served as Vice President - Development and as a project manager for the Company. Mr. Lebovitz was promoted to Vice President in 1993. Prior to joining CBL’s Predecessor, he was affiliated with Goldman, Sachs & Co. from 1986 to 1988. He is past president of the Jewish Community Federation of Greater Chattanooga, a past member of the national board of Hillel and a past member of the national board of Jewish Federations of North America. He formerly served on the United States Holocaust Memorial Council and was National Campaign Chair for the Jewish Federations of North America from 2010 – 2011. He was also a member of the board of the United Way of Greater Chattanooga and formerly served on the board of The McCallie School in Chattanooga. Michael I. Lebovitz is a son of Charles B. Lebovitz and a brother of Stephen D. Lebovitz and Alan L. Lebovitz.

Katie A. Reinsmidt serves as Executive Vice President – Chief InvestmentOperating Officer of the Company. She also serves as Chairperson of the Company’s Benefits Committee, heads CBL’s ESG TeamSteering Committee and is the Executive Sponsor for the Company’s diversity, equity, inclusion and belonging (“DEIB”) council, CBL Community. Ms. Reinsmidt served as Executive Vice President – Chief Investment Officer from February 2017 through May 2023, when she was promoted to her current position. She served as Senior Vice President – Investor Relations/Corporate Investments of the Company from September 2012 through February 2017, when she was promoted to her current position. She2017. Ms. Reinsmidt joined the Company as Director of Investor Relations in 2004 and previously was promoted to Director – Corporate Communications and Investor Relations in 2008 and to Vice President – Corporate Communications and Investor Relations of the Company in 2010. Prior to joining the Company, Ms. Reinsmidt served as an Associate Analyst at A.G. Edwards & Sons in St. Louis, Missouri, where she provided research coverage for retail, healthcare and lodging REITs. Ms. Reinsmidt received her Bachelor of Science degree in Economics from the University of Missouri – St. Louis. She also serves as a Trustee and SecretaryVice Chairperson of the City of Chattanooga General Pension Board, and served as its Secretary from February 2017 through May 2023 and Vice ChairmanChairperson from March 2011 through February 2017.

Involvement in Certain Legal Proceedings

As described above, ourOur financial and operating results during 2020 were significantly impacted by the temporary closure of our portfolio for a significant period due to government mandates and operating restrictions related to the COVID-19 pandemic and, on November 1, 2020, the Company, along with the CBL & Associates Limited Partnership, a Delaware limited partnership (the Company’s “Operating Partnership”) and certain of its direct and indirect subsidiaries, filed the voluntary petitions under chapter 11 of title 11 (“Chapter 11 Cases,”) of the United States Code, pursuant to which the Company subsequently obtained Bankruptcy Court confirmation of the a plan (the “Plan”) and emerged from Chapter 11 reorganization on the Effective Date.November 1, 2021. Certain of our above-referenced executive officers (Charles B. Lebovitz, Stephen(Stephen D. Lebovitz, Jeffery V. Curry, Alan L. Lebovitz, Michael I. Lebovitz and Katie A. Reinsmidt), as well as former Chief Financial Officer Farzana Khaleel, were executive officers of the Company at the time of such filing. The Board of Directors does not believe the filing of thethese Chapter 11 Casescases is material to an evaluation of the ability or integrity of any of the Company’s executive officers.

Operation of the Company’s Business; Certain Aspects of the Company’s Capital Structure

Our Company operates through its two wholly owned subsidiaries, CBL Holdings I, Inc., a Delaware corporation (“CBL Holdings I”), and CBL Holdings II, Inc., a Delaware corporation (“CBL Holdings II”). As of the April 6, 2023,8, 2024, record date for the Annual Meeting, through the referenced subsidiaries, our Company currently holds a 1.0% sole general partner interest and a 98.97%98.98% limited partner interest, for an aggregate total interest of 99.97%99.98% in our Operating Partnership.

14

Pursuant to the Operating Partnership Agreement, the limited partners possess certain rights (the “CBL Rights”), consisting of the right to exchange all or a portion of their Common Units in the Operating Partnership for shares of Common Stock or their cash equivalent, at the Company’s election. The CBL Rights may be exercised at any time and from time to time to the extent that, upon exercise of the CBL Rights, the exercising party shall not beneficially or constructively own shares of Common Stock in excess

15

of the applicable share ownership limits set forth in the Company’s Certificate of Incorporation. The Company, however, may not pay in shares of Common Stock to the extent that this would result in a limited partner beneficially or constructively owning in the aggregate more than its applicable ownership limit or otherwise jeopardize, in the opinion of counsel to the Company, the Company’s qualification as a REIT for tax purposes.

Our Company conducts substantially all of its business through the Operating Partnership. Our Company conducts its property management and development activities through the Management Company, which is a taxable REIT subsidiary, to comply with certain technical requirements of the Internal Revenue Code of 1986, as amended.

CORPORATE GOVERNANCE MATTERS

Governance Highlights

• | • Independent compensation consultant |

• Independent Chairperson | • Performance driven Executive Compensation, including specific ESG Goals |

• Separate CEO and Board Chairperson | • Nominating/Corporate Governance Committee oversight of CBL’s ESG Program |

• Fully independent Committees and Committee Chairpersons | • Prohibition against hedging, pledging and margin lending using Company shares |

• All Directors elected annually | • Double-trigger Change of Control for Executive Compensation |

• Director resignation policy | • Code of Conduct and Business Ethics for officers, employees and Directors certified annually |

• Annual Board and Committee evaluations | • Robust minimum stock ownership requirements for executive officers and Non-employee Directors |

• All Audit Committee Members are Audit Committee Financial Experts | • CBL does not make political contributions |

Our Board has adopted guidelines on corporate governance (including director independence criteria), committee charters, and a code of business conduct and ethics setting forth the Company’s corporate governance principles and practices. These documents can be accessed in the “Investor Relations – Governance – Governance Documents” section of the Company’s website at cblproperties.com.www.cblproperties.com. Effective as of November 1, 2021, our Company adopted the Second Amended and Restated Guidelines on Corporate Governance incorporating all previous guidelines on corporate governance, including all of the additional policy statements that had previously been added to such guidelines as described below, and also to eliminate the Executive Committee, add ESG oversight responsibilities to the Nominating/Corporate Governance Committee and revise the policy on Minimum Stock Ownership for Executive Officers with respect to the Chief Executive Officer, as described below. The Second Amended and Restated Corporate Governance Guidelines, as further amended by the Board of Directors effective November 10, 2022 to revise and clarify the minimum stock ownership guidelines for our Non-Employee Directors and Executive Officers, are referred to herein as the “Corporate Governance Guidelines”). See also “Corporate Governance Matters – Additional Policy Statements” below.

1615

Director Independence

Our Board has adopted a set of director independence standards (“Director Independence Standards”) for evaluating the independence of each of the directors in accordance with the requirements of the SEC and of the NYSE corporate governance standards. The Director Independence Standards are included as an exhibit to our Company’s Corporate Governance Guidelines, which can be found in the “Investor Relations – Governance – Governance Documents” section of the Company’s website at cblproperties.com.www.cblproperties.com. Pursuant to NYSE Rule 303A.02(a) and the provisions of our Company’s Director Independence Standards (as set forth below), our Board has reviewed whether any director has any relationship with the Company’s independent auditors that would preclude independence under SEC and NYSE rules, or any material relationship with our Company (either directly or as a partner, member, shareholder or officer of an organization that has a relationship with the Company) which could (directly or indirectly) materially impact the ability of such director or nominee to exert his or her independent judgment and analysis as a member of our Board. As a result of this review, our Board affirmatively determined that fivesix of our Company’s sixseven current directors were independent under the standards of the SEC and NYSE and as set forth in our Company’s Director Independence Standards. Stephen D. Lebovitz, who is the Chief Executive Officer of our Company and an employee of the Management Company, was deemed not independent.

In making the independence determinations with respect to the Company’s current Independent Directors, the Board of Directors considered the following factors:

In each case, the Board of Directors determined that the factors described above did not interfere with the independence of each of the above-referenced Independent Directors.

16

17

Additional Policy Statements

As described above, the Company has included additional policy statements as part of the Corporate Governance Guidelines. A summary of these policy statements, as so amended and currently in effect, is as follows:

Director Resignation Policy – a policy statement that requires a director who is nominated in an uncontested election but does not receive a “majority vote” to immediately tender his or her resignation to the Board of Directors for consideration. A “majority vote” means that the number of shares voted “for” a director must exceed the number of votes “withheld” with respect to the election of that director. The policy provides that if a director does not receive a “majority vote” and tenders his or her resignation, the Nominating/Corporate Governance Committee will make a recommendation to our Board of Directors on whether to accept or reject the resignation. The Board will then consider the Nominating/Corporate Governance Committee’s recommendation and publicly disclose its decision to either accept or reject the resignation within 90 days from the date of certification of the election results. The director whose resignation is being considered will not participate in the recommendation of the Nominating/Corporate Governance Committee or the decision of the Board of Directors.

Limits on Other Board Participation – a policy statement that limits to four (4) the number of other public company boards (not counting the Company’s Board) upon which a director may serve at any given time.

Minimum Stock Ownership for Non-Employee Directors – as amended, a policy statement that provides that by five (5) years from the later of (i) the adoption of the revised policy (November 10, 2022) or (ii) becoming a member of the Company’s Board, a Non‑Employee Director (a director that is not an employee of the Company, currently, the Independent Directors) must accumulate and hold at least an amount of shares of the Company’s Common Stock having a value, determined as set forth in the policy statement, equal to not less than five (5) times the amount of the Annual Cash Retainer that such Non‑Employee director shall receive from the Company. This policy statement includes an exemption for any Non‑Employee director who is prohibited by law or by the regulations of his or her employer from having an ownership interest in the Company’s securities.

Minimum Stock Ownership for Executive Officers – a policy statement that provides that by five (5) years from the later of (i) the adoption of the revised policy (November 10, 2022) or (ii) becoming an executive officer, such officer must own an amount of the Company’s Common Stock, determined as set forth in the policy statement, having a value at least equal to the following formula amounts:

Executive Officer |

| Level of Stock Ownership |

Chief Executive Officer |

| 6x prior calendar year’s annual base salary |

President |

| 3x prior calendar year’s annual base salary |

Chief Financial Officer |

| 3x prior calendar year’s annual base salary |

Chief |

| 3x prior calendar year’s annual base salary |

Chief Legal Officer |

| 3x prior calendar year’s annual base salary |

Executive Vice Presidents |

| 3x prior calendar year’s annual base salary |

Additional Policies Applicable to Minimum Stock Ownership Requirements for Non-Employee Directors and Executive Officers – For purposes of these requirements, the ownership of interests that are exchangeable for shares of Company stock (such as stock options, performance stock units (“PSUs”), restricted stock units (“RSUs”) or similar interests) will be deemed “owned” by an individual only after (A) as to stock options, the individual’s exercise of such stock options and the resulting acquisition of shares of stock; and (B) as to PSUs, RSUs and similar interests: (i) a determination that the performance goals or factors that must be satisfied to allow for the exchange of such PSUs, RSUs or similar interests for shares of stock have been met and (ii) such exchange is then implemented. A valuation formula for purposes of annual compliance testing under these requirements provides that shares of the Company’s Common Stock will be “valued” for such purpose at the greater of (A) their actual cost basis, for shares purchased by a Non-Employee Director or executive officer, (B) the tax basis for shares awarded to Non-Employee

1817

Directors and executive officers on a compensatory basis or (C) the average value of the Company’s Common Stock for the calendar year preceding the year in which such testing occurs, determined by using the average of the closing prices of the Company’s Common Stock on the NYSE on each trading day in the preceding calendar year. Further, any exceptions to the required minimum stock ownership levels for any Non-Employee Director or executive officer will be subject to review and discretionary approval by the Chairman of the Board’s Compensation Committee (or by the Chairman of the Nominating/Corporate Governance Committee, if such exception involves the Chairman of the Compensation Committee).

Changes in Director’s Principal Occupation or Business Association – a policy statement that provides that when the principal occupation or business association of a member of the Board of Directors changes substantially from the position he or she held at the time of their most recent election to the Board, such director shall promptly notify, in writing, the Chairperson of the Nominating/Corporate Governance Committee (or the other members of the Nominating/Corporate Governance Committee, if such affected director is the Chairperson). The Nominating/Corporate Governance Committee shall then review – with the affected director abstaining if he or she is a member – whether it is appropriate and in the best interests of the Company to allow the continued participation of such director as a member of the Board of Directors of the Company. If the Nominating/Corporate Governance Committee recommends that such director should no longer serve as a member of the Board of Directors of the Company as a result of such change, and the full Board of Directors (excluding the director at issue) ratifies such recommendation, then the Board of Directors shall request that the affected director submit a letter of resignation.

Initial Term of Director Appointed to Fill a Board Vacancy – a policy statement that provides that any director appointed by the Board of Directors of the Company to fill a vacancy created by the departure of another director shall serve only until the next regularly scheduled annual meeting of the Company’s shareholders. In order for such director to continue to serve thereafter, he or she must be nominated and duly elected for another full term.

Executive Sessions for Independent Directors

In accordance with the NYSE Rule 303A.03, the Independent Directors of the Company meet from time to time in scheduled executive sessions without management participation. Currently, these executive sessions are chaired by David J. Contis in his capacity as Non-Executive Chairman of the Board (prior to his becoming Non-Executive Chairman following the resignation of Jonathan M. Heller in January 2023, Mr. Contis chaired these sessions in his capacity as Lead Independent Director).Board. The Independent Directors met in sixfour executive sessions during 2022.2023.

Board Leadership Structure

Our Board of Directors has no formal policy with respect to the separation of the offices of Chairman and Chief Executive Officer. Prior to January 1, 2010, Charles B. Lebovitz had served as Chairman of the Board and Chief Executive Officer of the Company since the completion of its initial public offering in November 1993. During the fourth quarter of 2009, the Board determined that Stephen D. Lebovitz should be promoted to serve as Chief Executive Officer of the Company effective January 1, 2010. Pursuant to the terms of the Plan and concurrently with the November 1, 2021 Effective Date, Charles B. Lebovitz became Chairman Emeritus and Jonathan M. Heller became Non-Executive Chairman of the Board of Directors. David J. Contis succeeded Mr. Heller as Non-Executive Chairman of the Board in conjunction with Mr. Heller’s resignation in January 2023.

In connection with each of these changes to the structure of Company’s Board leadership, our Board of Directors also has considered the strong, ongoing leadership and oversight role played by the Company’s Independent Directors, which may be summarized as follows:

19

18

Board Diversity

The Board values diversity and believes that having a diverse Board is a competitive advantage that will make our Company stronger over time. We believe it is important to routinely assess the composition of the Board with a goal of striking a balance between the knowledge and understanding of the business that comes from longer-term service on the Board and the fresh ideas and perspective that can come from adding new members. We consider all dimensions of diversity in selecting directors (as summarized below for our current Director Nominees), including race, gender, sexual orientation, depth and breadth of professional and life experiences, and ethnic background and will continue to pursue opportunities to improve Board diversity.

Average Director Age: 58.860.3 years Average Tenure: 66.1 years Independence: 83%86%

Gender Diversity: 17%14% Racial/Ethnic Diversity: 17%29%

Board and Management Role in Risk Oversight

Assessing and managing risk is the responsibility of the management of our Company. Our Board is responsible for overseeing our risk management. The Board administers its risk oversight function through (1) the review and discussion of regular periodic reports to the Board and its committees on topics relating to the risks that the Company faces, including, among others, market conditions, tenant concentrations and credit worthiness, leasing activity, the status of current and anticipated development projects, compliance with debt covenants, management of debt maturities, access to debt and equity capital markets, environmental and social matters, cyber-securitycybersecurity risks and threat mitigation related to our technology and information systems, existing and potential legal claims against the Company and various other matters relating to the Company’s business; (2) the required approval by the Board of Directors of significant transactions that entail the expenditure of funds or incurrence of debt or liability in amounts in excess of certain threshold dollar amounts; (3) the review and discussion of regular periodic reports to the Board and its committees from the Company’s independent registered public accountants regarding various areas of potential risk, including, among others, those relating to the qualification of the Company as a REIT for tax purposes; and (4) the direct oversight of specific areas of the Company’s business by the Compensation, Audit and Nominating/Corporate Governance Committees.

2019

In addition, under its charter, the Audit Committee is specifically responsible for reviewing and discussing management’s policies with respect to risk assessment and risk management. The Company’s Director of Internal Audit meets regularly in executive sessions with the Audit Committee (at least quarterly and more frequently if necessary), for discussions of the Company’s oversight of risk through the internal audit function, including an annual review of the Company’s internal audit plan, which is focused on significant areas of financial, operating, and compliance risk, and periodic updates on the results of completed internal audits of these significant areas of risk. The Audit Committee also monitors the Company’s SEC disclosure compliance, and any related reporting risks, and receives regular reports from the Company’s Compliance Committee which assists the Audit Committee in exercising certain oversight responsibilities concerning the Company’s use of interest rate hedging instruments to manage our exposure to interest rate risk (including but not limited to entering swaps for such purpose and the exemption of any such swaps from applicable execution and clearing requirements).

Cybersecurity Risk Oversight and Mitigation

As part of its regular oversight of risk management, the Audit Committee also is responsible for the oversight of cybersecurity risk and threat mitigation related to our information technology and information systems, including protection and security of employee and customer data. Our Vice President – Technology Solutions is responsible for the day-to-day management of our cybersecurity. The Vice President – Technology Solutionscybersecurity program and reports directly to our President. The Audit Committee is responsible for overseeing cybersecurity risks, and Management reports to the Audit Committee on the Company’s cybersecurity program, current cybersecurity projects and industry trends and efforts to mitigate cybersecurity risk on at least a semi-annual basis. Additional information concerning the Company’s cybersecurity risk management and mitigation programs is set forth in Item 1C – Cybersecurity, contained in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC, that accompanies this Proxy Statement.

We contract with a third-party to perform a cybersecurity risk and vulnerability assessment annually. We regularly test areas of potential vulnerability, utilizing penetration testing, ransomware-focused disaster recovery tests as well as testing exercises for other higher risk areas. Additionally, our cybersecurity and information security controls are regularly tested by our auditors.

We have a comprehensive program designed to mitigate cybersecurity risk. We have adopted and require employees to abide by our Personally Identifiable Information Policy to help protect personal employee, vendor and tenant information. Employees are required to complete regular cybersecurity training and education annually, which is followed-up with quarterly testing and re-training, as necessary. We also maintain an incident response plan which outlines our response and action in the event of a major cybersecurity incident. The Company also maintains cybersecurity risk insurance coverage.

Over the past three years, we have not experienced a material information security breach and as a result, we have not incurred any material expenses from penalties and/or settlements related to such matters during that time. However, we have experienced two minor cybersecurity incidents, the latest of which occurred in November 2020. All incidents were resolved promptly, had no material impact on the Company’s reputation, financial performance, customer or vendor relationships, and posed no material risk of potential litigation or regulatory investigations or actions.

Communicating With the Board of Directors

The Company provides a process for shareholders and other interested parties to send communications to the Board or any of our directors. Such persons may send written communications to the Board or any of the directors c/o the Company’s Executive Vice President – Chief Investment Officer,CBL Investor Relations, CBL Properties, 2030 Hamilton Place Blvd., Suite 500, CBL Center, Chattanooga, Tennessee, 37421-6000. All communications will be compiled by the Company’s Executive Vice President – Chief InvestmentOperating Officer and submitted to the Board or to the individual director(s) to whom such communication is addressed. It is the Company’s policy that all directors attend the Annual Meeting unless they are prevented from attending due to scheduling conflicts or important personal or business reasons; provided, however, it is the Company’s policy that a majority of the directors (including a majority of the Company’s Independent

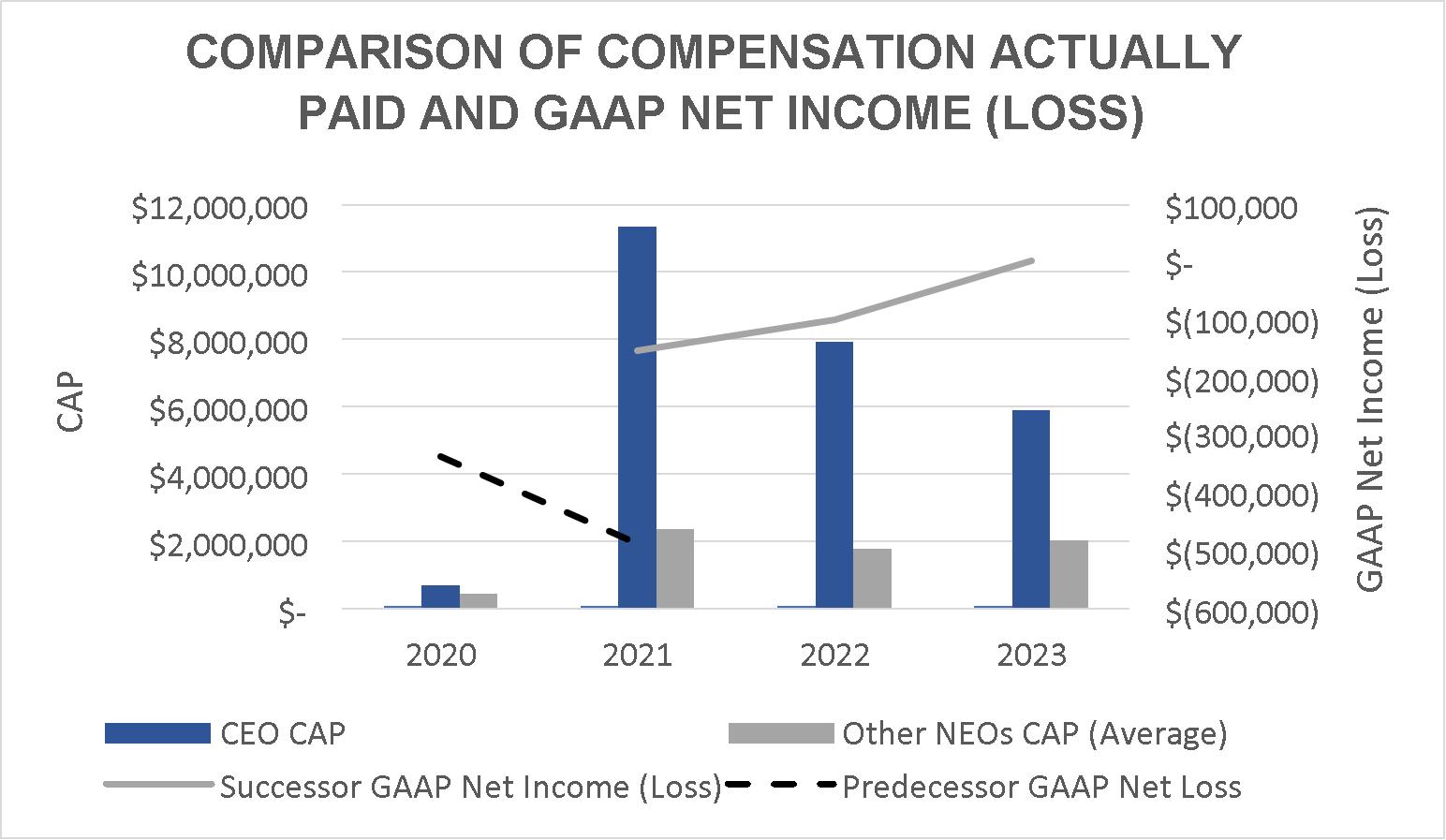

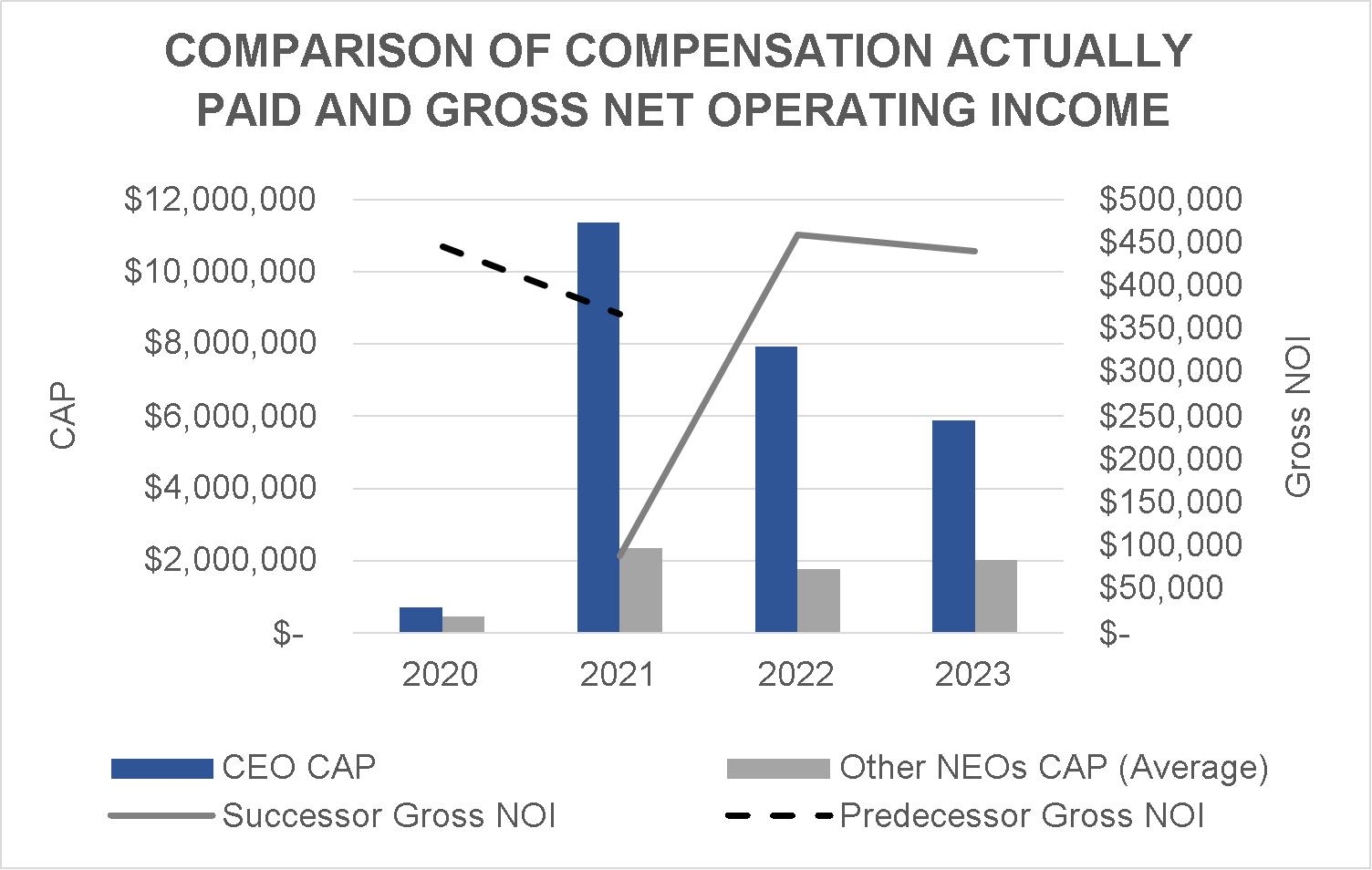

21